You've heard of borderless banks, now get ready for borderless stocks.

How to Invest in Tokenized Stocks And Build Your Wealth

Introduction

Imagine buying a fraction of a Tesla share for just $10. Or trading Apple stock at 2 AM on a Sunday.

If you don't know how to invest in tokenization stocks, then you won't know how to do this. Instead, you're stuck in the traditional stock market that is restricted by:

- Geographical walls that block global investors from buying into US-based companies like Apple or Tesla

- Ridiculous fees that eat into your returns and make small investments impractical.

- Time-zone traps that force you to trade during fixed market hours and wait days for settlement.

Tokenized stocks are a powerful new development that removes these barriers. They do this by using blockchain technology to represent real shares as digital tokens.

That means you can own fractional shares, trade in real-time, and access global markets with minimal fees.

This guide will walk you through how to invest in tokenization stocks step by step. We'll cover what tokenized equities are, the risks and benefits, and how you can start trading them.

Read on to start building generational wealth in the tokenized era.

Want to start building wealth via tokenization? Download the Kem app and find out how you can start.

What are tokenized stocks?

Tokenized stocks are digital assets that mirror real-world company shares, like Tesla, Apple, or Amazon.

Instead of being listed on traditional stock exchanges, they're created through stock or share tokenization. This is a process where the issuer uses blockchain to create a digital token tied to an underlying asset.

Think of them as blockchain-based shares. They move across blockchain networks instead of old-school brokerages, which makes them faster, cheaper, and more accessible. You don't need a Wall Street account or to deal with multiple financial institutions just to get in.

The best part? You don't have to buy an entire share, either. With fractional ownership, you can own just $10 worth of Tesla or $5 of Apple. This opens up stock investing to anyone, not just wealthy insiders.

Another huge development in this field is on-chain trading. Traditional markets are closed at night or on weekends. With the tokenized shares, you can buy, sell, and transfer anytime, anywhere.

"Tokenized trading allows you to trade stocks on the open market 24/7, any day of the week trade stocks on the open market"

— Zane Sadeq, Co-founder and President of Kem

The tokenization of bonds and stocks is part of a broader movement in digital tokens – alongside ETFs, security tokens, and DeFi projects – that's pulling the financial world toward a more decentralized future.

Quick Glossary of Useful Terms

| Term | Definition |

|---|---|

| Tokenized stocks | Digital tokens that represent ownership of real-world company shares on a blockchain |

| Fractional ownership | The ability to own a portion of an asset rather than purchasing a whole unit |

| On-chain trading | Buying and selling assets directly on blockchain networks, available 24/7 |

| Smart contracts | Self-executing contracts with terms directly written into code on the blockchain |

| DeFi | Decentralized Finance - financial services built on blockchain without traditional intermediaries |

| RWA | Real-World Assets - physical assets like real estate, stocks, or gold represented as digital tokens |

| KYC | Know Your Customer - identity verification required by regulated platforms |

| Issuer | The entity that creates and backs tokenized assets with underlying real-world assets |

Are tokenized stocks legal?

The first question most people ask: Is this legal? The short answer is yes, but it depends heavily on your jurisdiction.

Here's how it works:

- In some regions, like the European Union, tokenized stocks are regulated as financial instruments, just like traditional shares. That means they must follow the same rules on issuance, trading, and investor protection.

- In other countries, the rules aren't as clear. Tokenized assets may exist in a legal grey area where regulators haven't yet caught up with the tech.

This is where KYC (Know Your Customer) and compliance come in. Reputable tokenization platforms require users to verify their identity before trading.

Doing this helps tie your tokenized shares to real ownership and make sure they meet international compliance standards.

The bottom line: Tokenized stocks are legal in many regions, because the rules vary by issuer and country, always confirm where your investment stands before starting to trade.

Do tokenized stocks pay dividends?

This is where things get interesting. We know that traditional stocks often come with dividend payouts, but do tokenized shares?

The answer: sometimes. It depends on the tokens' structure and whether the issuer uses smart contracts to distribute earnings.

Here are three common variations:

- Some blockchain-based issuers mirror dividends from the underlying asset, sending payouts in stablecoins like USDT or in the same token itself.

- Other platforms give exposure to price movements only, without offering dividends or voting rights.

- Advanced setups use on-chain smart contracts to automate payouts in real-time whenever the issuing company distributes profits.

So, while tokenized stocks can provide dividends, not all of them do.

If they do, it won't work like your Robinhood account payout. Instead of waiting weeks for a bank transfer, you might receive your dividend instantly, directly into your crypto wallet.

The key? Check the ownership rights attached to the token. Does it mirror both price performance and dividend flow? Or is it synthetic exposure only?

Understanding this difference is critical before you invest.

What are the benefits of tokenized stocks?

Tokenized equities are more than a flashy trend: they solve real problems that hold back investors in traditional markets.

Big players like Kraken and Coinbase know this and are racing to launch tokenized stocks as they grapple for market share.

Here are some examples of those trading problems that tokenization deals with.

Lower barriers

With fractional ownership, the minimum investment is tiny. You can own an NVIDIA share for $10 or an Alphabet (Google) share for $5, for example.

Tokenization also breaks geographic walls, letting you access US stocks like Apple or Tesla without foreign brokers or heavy paperwork.

24/7 trading means more liquidity

Traditional markets run on fixed schedules, shutting down at night, on weekends, and during holidays.

Tokenized shares change that. Because they're issued and traded on-chain, you can buy and sell anytime. Markets don't "sleep," and trading activity stays constant.

Add in the fact that tokenized equities trade on global crypto exchanges, and you get a much larger pool of buyers and sellers.

The result? More liquidity, faster trades, and more opportunities to enter or exit positions on your own terms.

Lower costs

Traditional transactions require a chain of intermediaries, like financial institutions and brokers, each adding fees and delays.

Tokenization skips this complex and expensive process by using a direct, peer-to-peer blockchain network and minimizing the cost of trading.

Easier ownership and transfer

With tokenized trading, you can own fractions of multiple stocks and transfer them instantly. On-chain tokens enable the real-time (and secure) sending, selling, or gifting of shares, with ownership rights fully verifiable.

"An interesting feature of tokenized stocks is the ability for ownership transfer. Now, people can own a certain amount of stocks and easily transfer that ownership, which is something that was incredibly difficult before. Now you're able to transfer ownership of stocks, transfer ownership of anything that essentially becomes tokenized"

— Seth Sadeq, Co-founder and CEO of Kem

DeFi integrations and more asset classes

You can plug tokenized stocks into decentralized platforms to borrow, lend, or automate your portfolio strategy.

For investors, these options mean a completely different level of flexibility and freedom compared to the old stock market.

Tokenization isn't just for stocks, either. You'll see real estate, fine art, and even NFTs being tokenized. That's a whole new universe of RWAs (real-world assets) to diversify into.

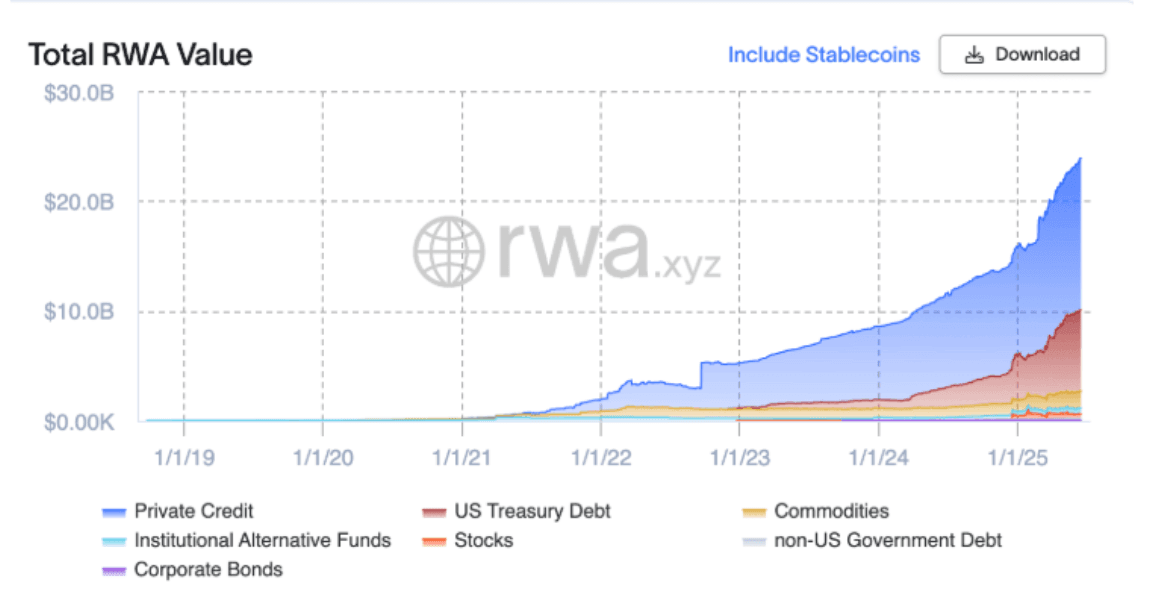

Recent data from Phemex, a leading crypto exchange, found that the total value of tokenized real-world assets on-chain reached $23.92 billion on June 18, 2025, up from just $3.5 billion in 2022.

Source: Phemex - The Growth of RWAs (2019-2025)

"Tokenization makes trading commodities a much more liquid process. Someone recently sold real estate in Dubai as a tokenized real-world asset, and we're going to see this type of transaction in many different verticals"

— Zane Sadeq, Co-founder and President of Kem

What are the risks of tokenization stocks?

Every new financial product comes with upsides and downsides — and tokenized equities are no exception. They offer global access, fractional ownership, and lower costs, but they also carry unique risks that investors need to understand before diving in.

Regulation

As mentioned above, tokenized stocks sit in a tricky legal space.

A tokenized Apple share might be regulated in one market but unrecognized in another. That's why it's important to stay informed about your region's stance and use platforms that prioritize compliance.

Issuer risk

When you buy a tokenized stock, you're trusting that the provider has properly backed the digital token with the underlying asset.

If they cut corners or fail to hold the real share, your investment could vanish. This is known as issuer risk, and it's one of the biggest concerns in the space.

Choosing a reliable licensed provider matters just as much as the stock itself. Kem, for example, operates via a VASP-licensed entity and partners with Tether, the issuer behind USDT.

Without that trust, a "fractional share" of Tesla is just a token without value — and you're left holding the bag.

Liquidity limits

Not every token has an active trading community yet. Some stocks may have plenty of buyers and sellers, while others barely move.

If you're holding a token with little demand, you might struggle to cash out when you want, so the safest move is to diversify across different asset classes and stick to tokens that already show healthy trading activity.

Traditional stocks vs. tokenized stocks – What's the difference?

Understanding the key differences between traditional and tokenized stocks helps you make informed investment decisions.

Traditional Stocks vs. Tokenized Stocks

| Feature | Traditional Stocks | Tokenized Stocks |

|---|---|---|

| Trading Hours | Fixed market hours (9:30 AM - 4:00 PM ET) | 24/7 trading availability |

| Accessibility | Requires brokerage account, geographic restrictions | Global access with internet connection |

| Minimum Investment | Full share price (can be hundreds/thousands) | Fractional ownership from $1-$10 |

| Settlement Time | T+2 (2 business days) | Instant on-chain settlement |

| Fees | Broker commissions, wire fees, currency conversion | Lower blockchain transaction fees |

| Ownership Transfer | Complex, requires broker intermediaries | Direct peer-to-peer transfer |

| Dividends | Automatic distribution via broker | Varies by issuer, can be automated via smart contracts |

| Regulation | Heavily regulated, established framework | Evolving regulatory landscape |

| Liquidity | High for major stocks | Growing but varies by token |

| Geographic Access | Limited by country regulations | Borderless (subject to platform restrictions) |

How to invest in tokenization stocks

Making the move into tokenized stocks can be daunting the first time. That's why choosing a trusted platform is so important.

Kem doesn't yet offer tokenized stock trading, but it's building toward that future. In the meantime, you can start preparing by getting comfortable with the Kem app's stablecoin features, so when tokenized equities go live, you'll be ready to trade safely and with confidence.

Here's what the process will look like once tokenized trading is launched:

Download the Kem app for free

Get your free Kem app in seconds. It's fully licensed and compliant, so you'll have no confidence or security concerns.

Start with a platform that's fully KYC-compliant. This ensures you can navigate regulatory uncertainty with confidence and security.

Fund with USDT for free

Kem already shows you how to buy and send USDT for free. Stablecoins avoid wild swings and make it easy to fund your account when you're ready to trade tokenized shares.

Browse tokenized assets

From Tesla and Apple to ETFs and beyond, you'll be able to explore tokenized stocks of the top 200 listed companies. Only verified providers will be listed to help minimize issuer risk.

Start small with fractional ownership

Fractional ownership means you won't need thousands upfront. Test the waters with as little as $10 and diversify across different financial assets to manage risk.

Automate your savings

Even before tokenized stocks launch, Kem's stablecoin savings account helps you grow your portfolio automatically, giving you yield on idle funds.

Trade anytime on-chain

When tokenized trading launches, you'll enjoy 24/7, blockchain-based markets with instant settlement — no waiting for Wall Street's bell.

Stay in control

Track your holdings, monitor dividends (if applicable), and access a secure on-chain record of your digital assets, all in one place.

Kem is building a platform that blends the best of blockchain networks, crypto tokens, and DeFi features. Soon, it won't just be a stablecoin wallet — it will be your gateway to tokenized equities.

Step into the future of tokenized assets with Kem

Knowing how to invest in tokenization stocks is only the beginning. Soon, almost any financial asset could exist as a digital token.

We're already seeing experiments in:

- Tokenized real estate (fractional property ownership).

- Fine art investment through NFTs.

- Tokenization of bonds and ETFs.

- Security tokens for regulated financial instruments.

This expansion of asset classes creates a world where investing is truly borderless. A student in Asia could own a piece of New York real estate. A retiree in Europe could hold fractional ownership in a Picasso.

As blockchain technology evolves, expect more use cases, stronger compliance, and greater adoption. Platforms like Kem are building the bridge — turning crypto into a true alternative to the banking system.

The future of investing is tokenized, global, and always on. Make sure you're ready to claim your stake.

Ready to join the Kem revolution? Sign up today and start growing your digital wealth in seconds.

Frequently asked questions (FAQ)

What are tokenized stocks?

Tokenized stocks are digital assets that represent real-world company shares using blockchain technology. They allow you to own fractional shares, trade 24/7, and access global markets with minimal fees.

Are tokenized stocks legal?

Yes, tokenized stocks are legal in many regions, though regulations vary by country. In the EU, they're regulated like traditional financial instruments. Always check your local regulations and use KYC-compliant platforms.

Do tokenized stocks pay dividends?

Sometimes. It depends on the token's structure and whether the issuer uses smart contracts to distribute earnings. Some mirror dividends from underlying assets, while others only provide price exposure.

What are the benefits of tokenized stocks?

Benefits include lower investment barriers through fractional ownership, 24/7 trading access, reduced costs by eliminating intermediaries, easier ownership transfers, and integration with DeFi platforms for enhanced flexibility.

What are the risks of tokenized stocks?

Main risks include regulatory uncertainty, issuer risk (whether the token is properly backed), and liquidity limits for less popular tokens. Always research platforms thoroughly and diversify your holdings.

#TokenizedStocks #Blockchain #CryptoInvesting #DeFi #RWA #Kem #DigitalFinance #FractionalOwnership

September 19, 2025