Cashing out your earnings has never been so easy

What's the Best App For Withdrawing Crypto to Bank Accounts?

Introduction

You've mined it, traded it, maybe even staked it, but now comes the tricky part: turning your crypto into real-world cash.

For many, finding the best app to withdraw crypto to a bank account can feel like trying to open a treasure chest with the wrong key. The path from cryptocurrency to cash feels littered with confusing interfaces, hidden fees, and days-long delays.

But what if there was a way to make your Bitcoin, USDT, and ETH feel like instant cash, anywhere in the world?

In other words:

- No complicated transfers

- No sky-high withdrawal fees

- And no waiting for blockchain confirmations.

In this guide, we've rounded up the 6 best apps to withdraw crypto to bank accounts, taking into account speed, fees, security, and user experience, so you can finally spend your digital assets like real money.

What if you could turn your digital assets into real money instantly? Download the Kem app and find out how you can spend your crypto like cash, anywhere in the world.

What is the best way to withdraw crypto to a bank account?

The crypto world has developed several ways to cash out your crypto; each offers different advantages and downsides.

Think of it like choosing between a budget airline, a high-speed train, or a private taxi – they'll all get you to the same destination, but the experience (and cost) is very different.

Here are three of the most popular methods.

Centralized exchanges

Centralized exchanges like Coinbase, Binance, and Kraken allow you to sell cryptocurrency and transfer fiat directly to your bank.

Pro: Often lower fees and have wide fiat support.

Con: Withdrawals can take several business days, especially across borders.

Crypto wallets with off-ramp features

The best crypto wallets have off-ramp features that let you cash out without moving funds to a separate exchange.

Pro: Fast and convenient, with fewer steps involved.

Con: May come with higher withdrawal fees or limited fiat currency options compared to exchanges.

Payment apps

Payment apps such as PayPal and Crypto.com integrate bank withdrawals so that you can get hold of your cash in just a few clicks.

Pro: Extremely user-friendly and great for beginners.

Con: Often have limited cryptocurrency support and higher transaction costs.

The best choice for you depends on what matters most: instant access, low fees, or user-friendly design.

A great app can combine all of these, giving you speed, affordability, and simplicity in one place.

The next section explores the six best apps that can help you make your crypto more liquid.

What's the best app to withdraw crypto to your bank account? 6 top providers

Turning crypto into cash shouldn't feel like solving a Rubik's Cube on a rollercoaster. You've worked hard stacking BTC, ETH, or USDT, but when it's time to actually pay rent, book flights, or grab a Friday-night pizza, you need a smooth off-ramp.

The good news? You've got options.

Here are six of the best apps for withdrawing crypto to bank accounts.

Best Crypto Apps to Withdraw to Bank Accounts

| Platform | Best For | Key Feature | Withdrawal Speed | Fees |

|---|---|---|---|---|

| Kem | Everyday users | Crypto debit card + instant transfers | Instant (coming soon for bank withdrawals) | Low |

| Coinbase | Beginners | Highly regulated, trusted platform | 1-3 business days | Medium-High |

| OKX | Advanced traders | All-in-one ecosystem with DeFi | 1-5 business days | Variable |

| Kraken | Security-conscious | Industry-leading security | 1-3 business days | Low-Medium |

| Binance | Global traders | Lowest fees, most currencies | 1-3 business days | Low |

| Crypto.com | Casual spenders | Easy-to-use debit card | 1-3 business days | Medium |

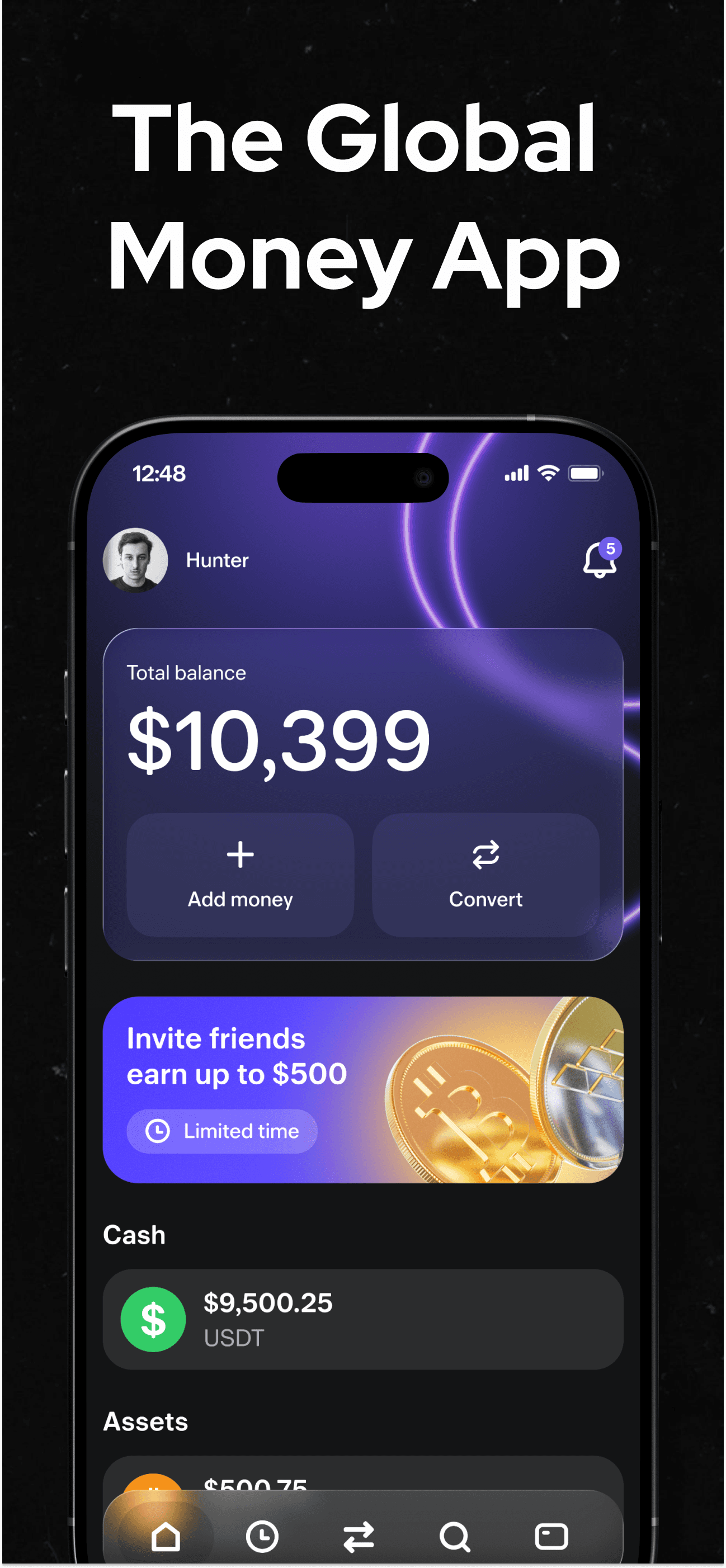

Kem – The Bank of Tomorrow

This article may be about the best apps for withdrawing crypto to bank accounts, but Kem is much more than that.

Kem's mission is simple: to make your digital money as easy to use as cash.

Where other platforms bury users under clunky interfaces and hidden fees, Kem is built for speed, affordability, and everyday use.

Kem takes the uncertainty out of crypto by partnering with Tether, the issuer of USDT, and Tron, a leading blockchain network known for fast, low-cost transactions.

This combination means you don't have to worry about sudden price swings or waiting days for transfers to clear. Instead, you can send money to a friend, pay a bill, or swap between assets in seconds.

You can do this in three simple steps:

- Enter the amount – Choose your preferred currency (USDT, BTC, ETH, etc.), type in the amount you want to send, and get ready to transfer instantly.

- Select the recipient – Pick a contact from your saved list, or just enter their phone number. No wallet address needed.

- Confirm and send – Review the details, hit confirm, and your funds are on their way. Transfers typically land in milliseconds, depending on the asset.

Kem's Three-Step Crypto Transfers

Kem's dedicated cards also let you spend crypto directly – whether it's buying a coffee, shopping online, or booking a flight – without the hassle of manual conversion.

If you're looking to find out how to invest in tokenization stocks, then Kem will soon have a feature that will let you do that in seconds, too.

Soon, Kem will also roll out direct crypto withdrawals to bank accounts, giving customers the final piece of the puzzle. That means you'll be able to cash out your USDT, BTC, or ETH into USD, EUR, or GBP in just a few taps – no clunky transfers, no waiting days for funds to clear.

With Kem, your crypto works seamlessly in the real world, giving you freedom, control, and a smooth experience inside one clean, user-friendly app.

Best for: Everyday crypto users who want instant access to their money, not just traders.

Key feature: A dedicated card that turns crypto into spendable cash anywhere, instantly.

Why choose Kem: Combines speed, low interest rates, and usability in one platform, making it a true alternative to traditional banking.

Coinbase

Coinbase is often the first stop for anyone starting their crypto journey – and for good reason.

With its clean design, clear tutorials, and reputation as one of the most regulated platforms in the world, it's become the go-to gateway for millions of beginners, as well as experienced traders.

Yet, this comes with a trade-off.

"Coinbase is the only major publicly-traded cryptocurrency exchange in the U.S. But its customers pay more for this perceived safety in fees and transaction costs"

— Javier Paz, Acting CTO at Stealth Startup

On the one hand, you get a platform that feels safe, trusted, and fully compliant with U.S. regulations, complete with bank transfers, debit card withdrawals, and strong security measures like two-factor authentication.

On the other, transaction fees can be higher than competitors, especially when selling smaller amounts of BTC, ETH, or stablecoins like USDC.

Still, Coinbase makes it easy to cash out to USD, EUR, or GBP quickly, with bank withdrawals in just a few taps and near-instant transfers in some regions. It's one of the most user-friendly apps out there, even if you're brand new to crypto exchanges.

Best for: Beginners who want a trusted, regulated way to turn crypto into fiat.

Key feature: Direct bank transfers backed by a highly regulated, publicly traded exchange.

Why choose Coinbase: A balance of security, ease-of-use, and fiat support, though fees may be higher than alternatives.

OKX

OKX has built a reputation as a full-service platform that goes far beyond simple buying and selling.

It has a sleek interface and supports everything from BTC and ETH to emerging coins like SOL and DOGE. Its designed for users who want flexibility without leaving one app.

Its biggest strength lies in its ecosystem: you can trade, stake, explore DeFi opportunities, and cash out directly to your bank account or debit card.

Withdrawals in USD, EUR, or GBP are generally smooth, though they may take longer depending on your payment method.

The flip side? With so many features packed in, OKX can feel overwhelming for complete beginners, and fees can vary depending on how you structure your trades and withdrawals.

Best for: Users who want an all-in-one crypto exchange with advanced features.

Key feature: A broad ecosystem covering trading, DeFi, staking, and fiat withdrawals.

Why choose OKX: It's a versatile platform that balances innovation with practical off-ramp options.

Kraken – Security first

Kraken is another long-standing name in the crypto world.

It's known for its rock-solid security measures and no-nonsense approach, so it's a favorite for users who prioritize safety above all else.

With Kraken, you can sell crypto assets like BTC, ETH, and USDC and withdraw directly to your bank account in multiple currencies, including USD, EUR, and GBP.

Processing times vary, but transfers are reliable and backed by a platform with a spotless track record.

The trade-off? Kraken's interface is less flashy than rivals, and it may feel less "beginner-friendly."

Yet for anyone serious about protecting digital assets – with features like cold storage, two-factor authentication, and strict compliance – it's hard to beat.

Best for: Security-conscious users who want a tried-and-tested exchange.

Key feature: One of the safest and most regulated platforms for crypto-to-fiat withdrawals.

Why choose Kraken: A platform with industry-leading security and a strong reputation for reliability.

Binance – The Global Giant

As the world's largest crypto exchange by trading volume, Binance is impossible to ignore.

Its appeal comes from sheer breadth: more trading pairs, more features, and often lower transaction fees than competitors. From Bitcoin wallets to NFTs and staking, it's a one-stop shop for global crypto users.

Binance also supports a wide range of fiat currencies and bank transfers, giving users plenty of off-ramp flexibility. It also offers debit card integration in some regions, making it easy to spend digital assets in real life.

That said, Binance has faced regulatory scrutiny in several countries, which can sometimes limit services or add extra steps to KYC verification.

Best for: Active traders and global users who want variety and low fees.

Key feature: Extensive fiat support and low-cost withdrawals across multiple regions.

Why choose Binance: Huge selection, competitive fees, and flexible cash-out options—though regulations may vary by location.

Crypto.com – Spend anywhere

Crypto.com has made a name for itself with its marketing but its debit card integration is where it really shines.

This feature lets you spend crypto directly, turning digital assets into coffee, flights, or online shopping without needing to convert first.

The app also supports bank transfers in USD, EUR, and GBP, making it simple to cash out when you need to. Beginners are comfortable using it thanks to its polished, user-friendly design and strong customer support.

One potential downside is that fees can be higher compared to crypto exchanges, and crypto selection is narrower than platforms like Binance or OKX.

Still, for everyday usability, Crypto.com delivers.

Best for: Beginners who want a straightforward way to spend and withdraw crypto.

Key feature: Debit card that connects your crypto to real-world payments.

Why choose Crypto.com: Intuitive design, everyday usability, and easy bank withdrawals.

Step-by-step guide: How to withdraw crypto to your bank account

Cashing out your crypto may have once felt like rocket science, but now it's straightforward, no matter if you're cashing out USDT or DOGE.

Here's how to move your digital assets into fiat like USD, EUR, or GBP without the stress.

1. Choose a platform

Pick an app or crypto exchange you trust, options like Kem and Kraken are known for holding high trust levels among their customers.

Look for strong security measures such as two-factor authentication and private key protection, plus responsive customer support if you need help.

2. Complete KYC verification

Most platforms require KYC checks to keep regulators happy. That usually means uploading an ID and confirming some details.

It only takes a few minutes, but it's a must before you can make bank transfers.

3. Transfer funds into the app

Move your crypto from your Bitcoin wallet or another storage option into your chosen app.

Double-check the wallet address: once funds are sent on the blockchain network, there's no undo button.

4. Sell crypto to fiat

Convert your digital assets into the currency you want. Most apps support USD, EUR, or GBP, though your options will depend on your payment method and location.

5. Link a bank or debit card

Add your bank account or link a debit card for faster access to cash. Some apps also support near-instant bank transfers, making it easier to turn your digital assets into spendable funds.

6. Confirm the withdrawal

Before hitting confirm, review the transaction fees and expected processing time. Once you approve, you can track the progress in the app until the funds hit your account.

Withdrawing crypto isn't as intimidating as it sounds. The key is choosing the platform that matches your priorities: speed, low fees, or rock-solid security.

If you want cryptocurrency withdrawals with top-class security and an easy user experience, Kem is hard to beat.

If you're focused on more old-school options, then the likes of PayPal and Revolut also keep things simple, but may come with extra fees and a higher processing time.

No matter your pick, the end goal is the same: turning your digital assets into everyday cash: quickly, safely, and without unnecessary headaches.

Ready to start turning your crypto into cash? Sign up today with Kem and we'll show you how to it instantly.

Frequently asked questions (FAQ)

What is the best way to withdraw crypto to a bank account?

The best way depends on your priorities. Centralized exchanges like Coinbase and Kraken offer low fees and wide fiat support but may take longer. Crypto wallets with off-ramp features are faster but may have higher fees. Payment apps like Crypto.com are user-friendly but may have limited crypto support.

Which crypto wallet can withdraw to a bank account?

Several wallets support bank withdrawals, including Kem (coming soon), Coinbase Wallet, and Crypto.com. Look for platforms that offer KYC-compliant off-ramp features and support your local currency.

Which crypto app has instant withdrawal?

Kem offers near-instant transfers for crypto-to-crypto transactions and will soon support instant bank withdrawals. Coinbase also offers instant transfers in some regions, though this depends on your bank and payment method.

Are there fees for withdrawing crypto to a bank account?

Yes, most platforms charge fees for crypto-to-fiat conversions and bank withdrawals. Fees vary by platform, payment method, and amount withdrawn. Always review the fee structure before confirming your withdrawal.

#CryptoWithdrawal #Bitcoin #Ethereum #USDT #Coinbase #Kraken #Binance #Kem #DigitalFinance #CryptoWallets

September 26, 2025